The slide presentation below provides a snapshot of key economic indicators--some of the important ingredients that shows if the US economy is vibrant & healthy.

Many of the slides come from BullandBearWise.com This organization provides regular updates as new information is released. From time-to-time I will update this particular blog article with the latest news.

Before viewing the slides, it would be instructive to discuss these indicators:

Bull/Bear Index This is a composite index of the state of the US economy.

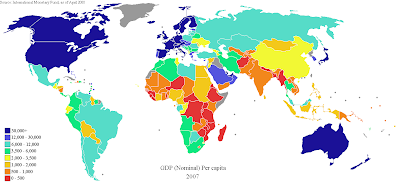

Gross Domestic Product (GDP) This is the total cost of all finished goods and services produced. See That GDP for more information.

TED Spread The TED spread is a common measure of fear and risk in the capital markets. See Where's TED Now for more information.

Inflation Right now deflation is an important concern. This slide provides a hint as to the direction of that risk.

ISM Manufacturing Index Any reading above 50 is considered a healthy sign for US manufacturers. These companies often make Durable Goods and Export products, hence those two charts follow.

ISM Non-Manufacturing Index Comparable to manufacturing, this measures the health of the US services industry. The Retail Sales chart provides further detail.

Housing Market Index This is comparable to the manufacturing & services indexes. Again, a reading above 50 is healthy. This is supported by the Housing Affordability Index--and indication of whether buyers can, in general, afford to purchase homes.

Unemployment Rate This is a vital measure of the US workforce--and naturally a low unemployment rate means workers can afford to buy durable goods, services & homes. Consumers are one of the key drivers of US economic growth. The Initial Jobless Claims report provides a glimpse of where the unemployment rate is trending.