Even if we have a recovery from this recession in the next few months--which is predominately measured by Gross Domestic Product (GDP)--many people will continue to be unemployed for months following the US recovery and advancement in GDP growth. This is typical for a recession. Jobs recovery to more normal levels typically follows many months after the overall economic recovery.

There is a wide diversity of unemployment rates across the states.

Michigan is hit the hardest, largely because of their dependence on the Big Three auto industry. Their unemployment rate is 12.6%.

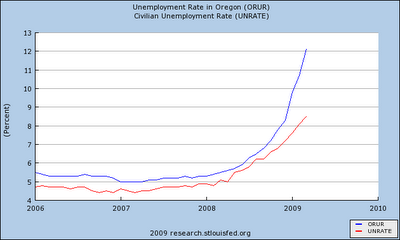

Did you know that Oregon ranks second, with an unemployment rate of 12.1%? Why, you might ask. Some say it is due in part to an exceptionally high minimum wage law. Economist have often argued that minimum wage laws, in their effort to help the lower wage earners, have a tendency to suppress hiring.

Oregon's minimum wage rose by 45 cents an hour, to $8.40 on January 1, even as the state's jobless rate was rocketing up 1% a month. This substantial jump in wages at the same time the economy was crumbling seems certain to have forced businesses to cut more employees from their workforce.

Oregon lawmakers are considering a bill that would override a 2002 citizen initiative and block future minimum wage increases indexed to inflation.

Now lets look at a brighter side. Early this year Wyatt Watson surveyed major companies to assess whether they intended further layoffs. You can see that by February, 2009 many companies in this survey had already made their moves, with just 13% expecting further cuts in the coming twelve months.

Weekly unemployment claims seems to be signaling the end of the current recession. They recently dropped unexpectedly by a fairly large amount (610K instead of the expected 660K). This claims growth peaked in early March and has since dropped meaningfully. We need to see more follow-through but this could mark an inflection point in the economy and jobs market.

Robert Gordon, an economics professor at Northwestern University, says that as far back to the late 1960s, he has found that the four-week average of new claims peaks about a month before the declared end of recessions.

This four-week average claims series reached a level of 659,500 in the week ending April 4. This would mean the recession ended somewhere between late March and early May!

That's a very optimistic outlook on the economy. The latest Wall Street Journal survey of economists shows on average they expect the recession to end in September.

Professor Gordon's observation relating weekly unemployment claims and the end of the current US recession is a very big "IF." It remains to be seen whether jobless claims will have the same predictive power they’ve shown in the past.

No comments:

Post a Comment